Avaya Announces Certain Preliminary Third Quarter Fiscal 2022 Financial Results

Raleigh-Durham, NC – July 28, 2022 - Avaya Holdings Corp. (NYSE: AVYA) today announced certain preliminary financial results for the third quarter ended June 30, 2022 and expects to release full results for the third quarter on August 9, 2022.

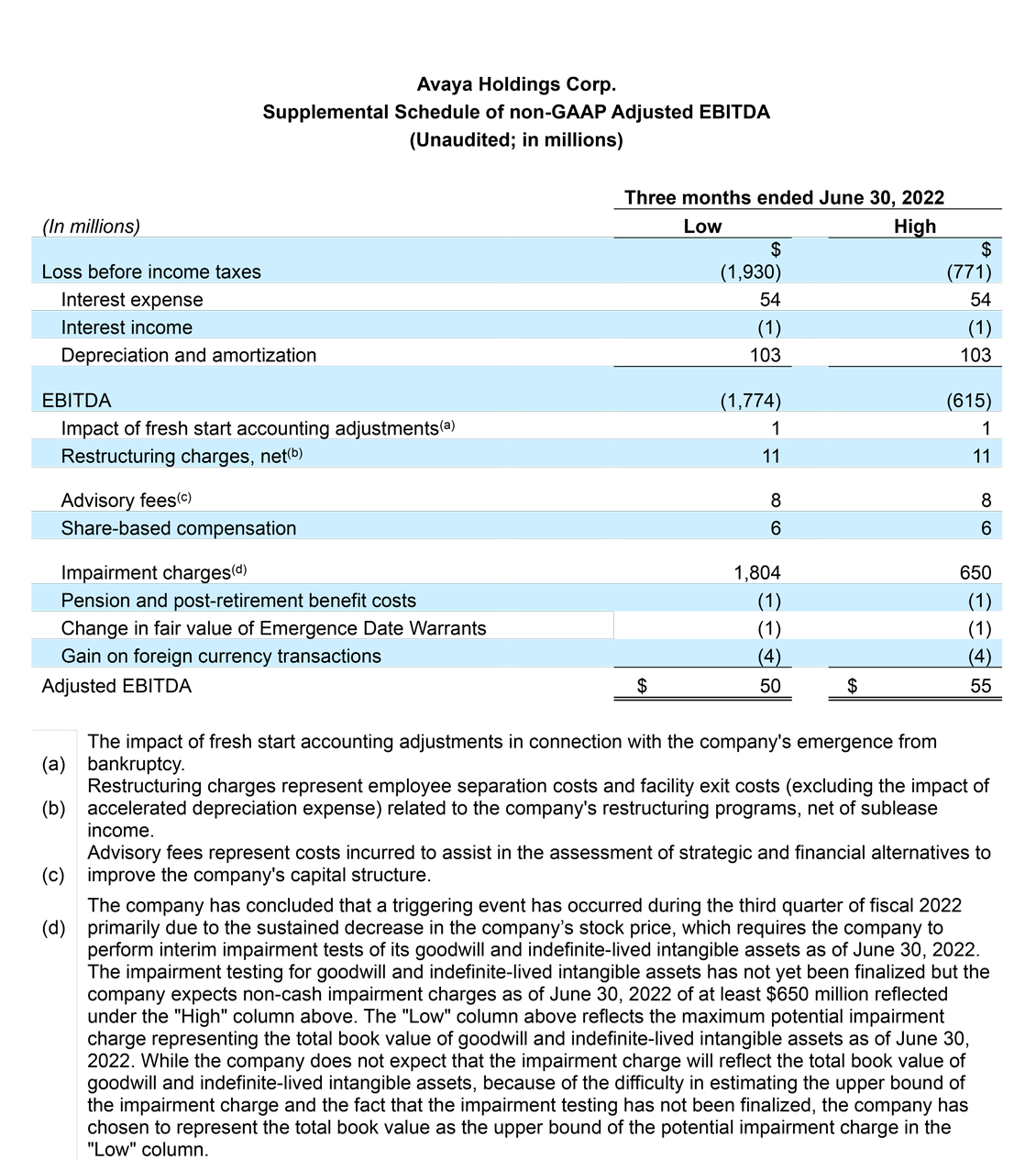

Based on the information currently available for the third quarter ended June 30, 2022, the company expects revenue to be between $575 million and $580 million, compared to guidance of $685 million to $700 million, and Adjusted EBITDA to be between $50 million and $55 million, compared to guidance of $140 million to $150 million.1 The company is also finalizing testing of its goodwill and intangible assets that is expected to result in significant non-cash impairment charges as of June 30, 2022.

Avaya also announced it has initiated cost-cutting measures that are expected to primarily impact the company’s overall selling, general and administrative expenses, as well as discretionary spending. These actions are expected to generate between $225 million and $250 million in annual cost reductions beginning in the first quarter of fiscal 2023. The company expects to minimize any impact to customers with respect to sales and support, and remains committed to Avaya’s long-range innovation and product development roadmaps.

The company’s prior financial guidance should no longer be relied upon. Management will provide additional information in conjunction with the upcoming release of its full third quarter 2022 financial results.

The financial results for the three months ended June 30, 2022 included in this release are preliminary, have not been reviewed or audited, are based upon Avaya’s estimates, and were prepared prior to the completion of the company's financial statement close process. The preliminary financial results should not be viewed as a substitute for the company’s full third quarter results and do not present all information necessary for an understanding of Avaya’s financial performance as of June 30, 2022. Accordingly, undue reliance should not be placed on this preliminary data.

Conference Call and Webcast

Avaya expects to report financial results for the third quarter of fiscal 2022 ended June 30, 2022 on Tuesday, August 9, 2022 before the market open. Avaya will host a live webcast and conference call to discuss its financial results at 8:30 a.m. Eastern Time.

To access the conference call by phone, listeners should dial +1-877-858-7671 in the U.S. or Canada and +1-201-389-0939 for international callers. A replay of the conference call will be available for one week by dialing +1-877-660-6853 in the U.S. or Canada and +1-201-612-7415 for international callers, using the access code: 13731758. To join the live webcast, listeners should access the investor page of Avaya’s website https://investors.avaya.com/. Following the live webcast, a replay will be available for a period of one year.

1 Guidance was presented using April 30, 2022 FX rates. Preliminary results presented using June 30, 2022 FX rates.

Corporate Communications

Tyler Chambers

Avaya Investor Relations

tmchambers@avaya.com

+1-669-242-8161

About Avaya

Avaya is an enterprise software leader that helps the world’s largest organizations and government agencies forge unbreakable connections.

Learn more at https://www.avaya.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “our vision,” “plan,” “potential,” “preliminary,” “predict,” “should,” “will,” or “would” or the negative thereof or other variations thereof or comparable terminology. Avaya has based these forward-looking statements on its current expectations, assumptions, estimates and projections. While the company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond its control. Risks and uncertainties that may cause these forward-looking statements to be inaccurate include, among others, finalization of the company’s third quarter financial statements (including finalization of the company’s impairment tests), completion of standard quarter-close processes, and the impact and timing of any cost-savings measures, as well as other factors discussed in the company’s Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”). These risks and uncertainties may cause the company’s actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a further list and description of such risks and uncertainties, please refer to the company’s filings with the SEC that are available at www.sec.gov. The company cautions you that the list of important factors included in the company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this press release may not in fact occur. The company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Use of non-GAAP (Adjusted) Financial Measures

The information furnished in this release includes non-GAAP financial measures that differ from measures calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”). EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization. Adjusted EBITDA is EBITDA further adjusted to exclude certain charges and other adjustments described in our SEC filings and the tables below. We believe that including supplementary information concerning adjusted EBITDA is appropriate because it serves as a basis for determining management and employee compensation and it is used as a basis for calculating covenants in our credit agreements. In addition, we believe adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our current capital structure. We also present adjusted EBITDA because we believe analysts and investors utilize these measures in analyzing our results. Adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, such as our pricing strategies, volume, costs and expenses of the organization, and it presents our financial performance in a way that can be more easily compared to prior quarters or fiscal years. EBITDA and adjusted EBITDA have limitations as analytical tools. EBITDA measures do not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. Adjusted EBITDA excludes the impact of earnings or charges resulting from matters that we do not consider indicative of our ongoing operations but that still affect our net income. In particular, our formulation of adjusted EBITDA allows adjustment for certain amounts that are included in calculating net income (loss), however, these are expenses that may recur, may vary and are difficult to predict. In addition, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation.

The company presents constant currency information to provide a framework to assess how the company’s underlying businesses performance excluding the effect of foreign currency rate fluctuations.