Avaya Reports First Quarter Fiscal 2022 Financial Results

Avaya Reports First Quarter Fiscal 2022 Financial Results

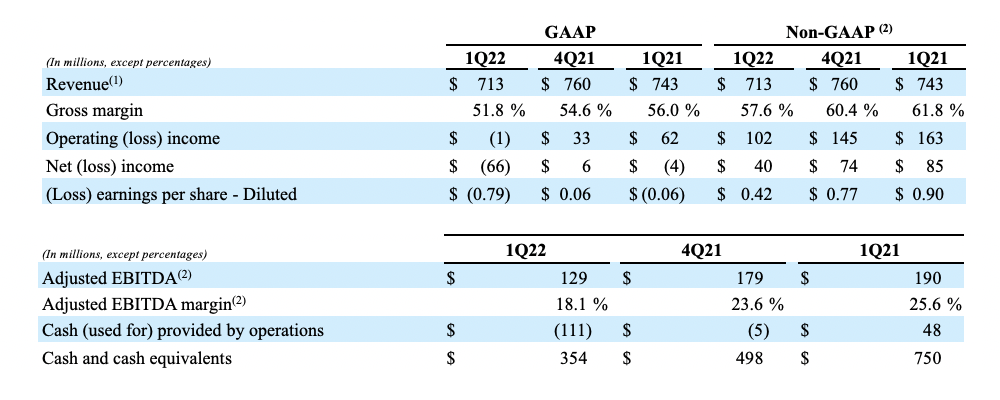

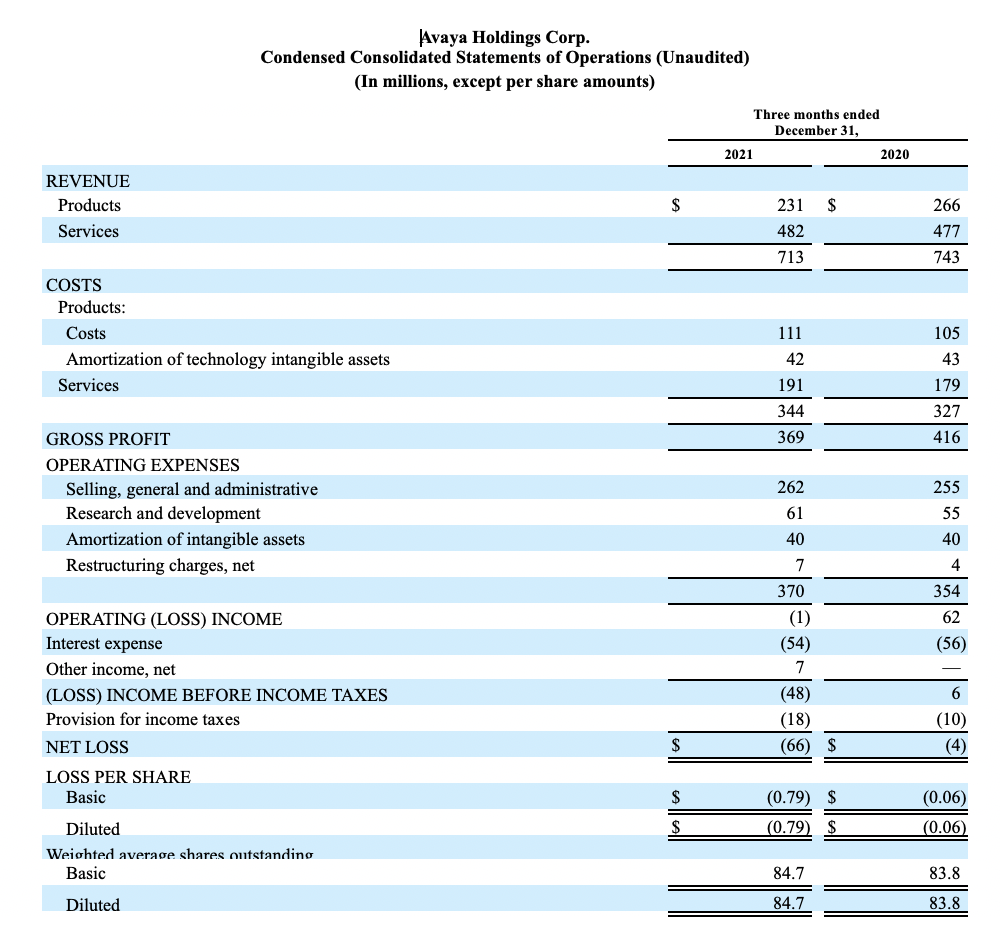

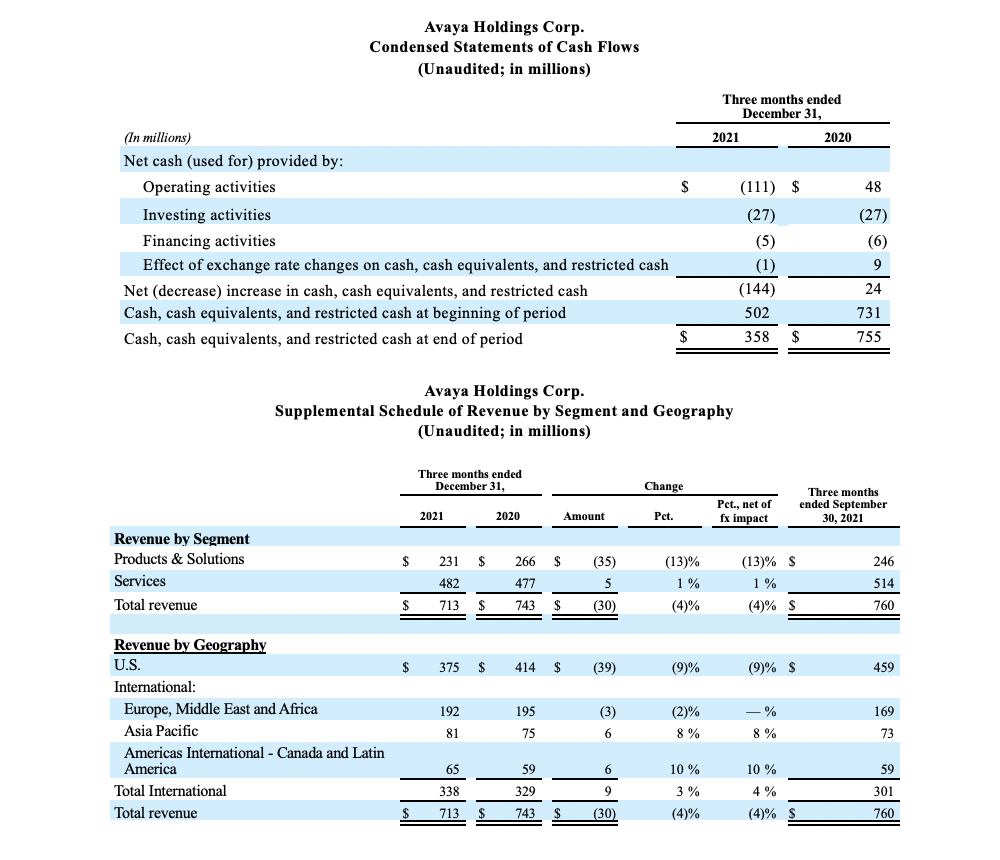

Total revenue was $713 million

Avaya OneCloud™ ARR increased 137% year over year to $620 million

Signed 100+ deals with TCV greater than $1 million, for the 7th consecutive quarter

Signed largest Avaya OneCloud deal in the company's history

Raleigh-Durham, NC, - February 9, 2022 - Avaya Holdings Corp. (NYSE: AVYA) today reported financial results for the first quarter of fiscal 2022 ended December 31, 2021.

First Quarter Financial Highlights

- Revenues of $713 million

- OneCloud ARR (Annualized Recurring Revenue) was $620 million, up 17% sequentially and 137% from a year ago

- CAPS (Cloud, Alliance Partner and Subscription) was 44% of revenue, up from 34% a year ago

- Software and Services were 86%; Software was 62% of total revenue

- Recurring revenue was 66% of revenue, up from 65% a year ago

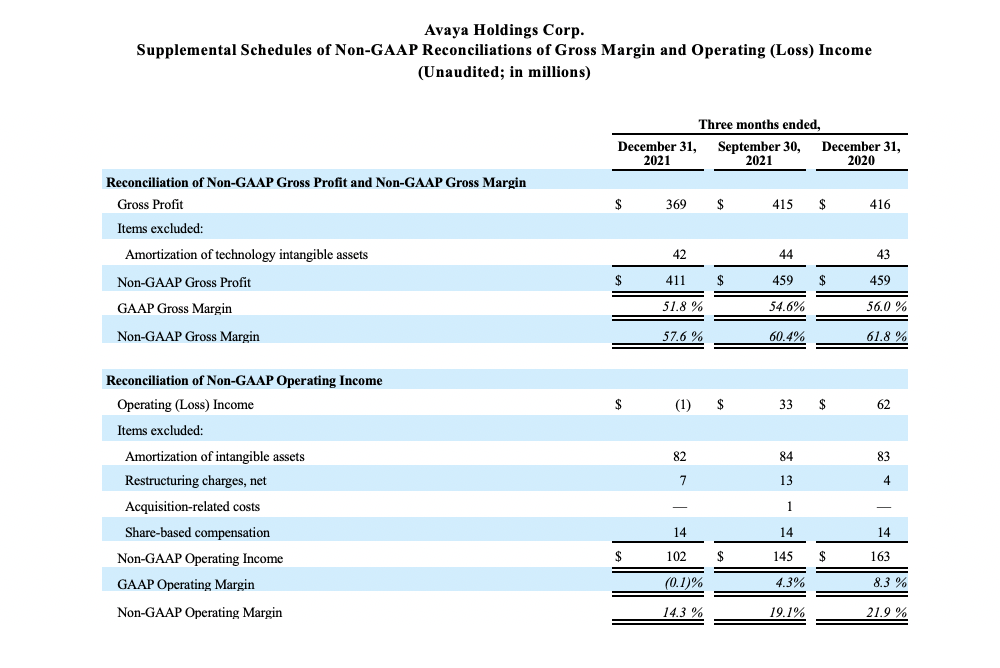

- GAAP Operating loss was $1 million and Non-GAAP Operating income was $102 million

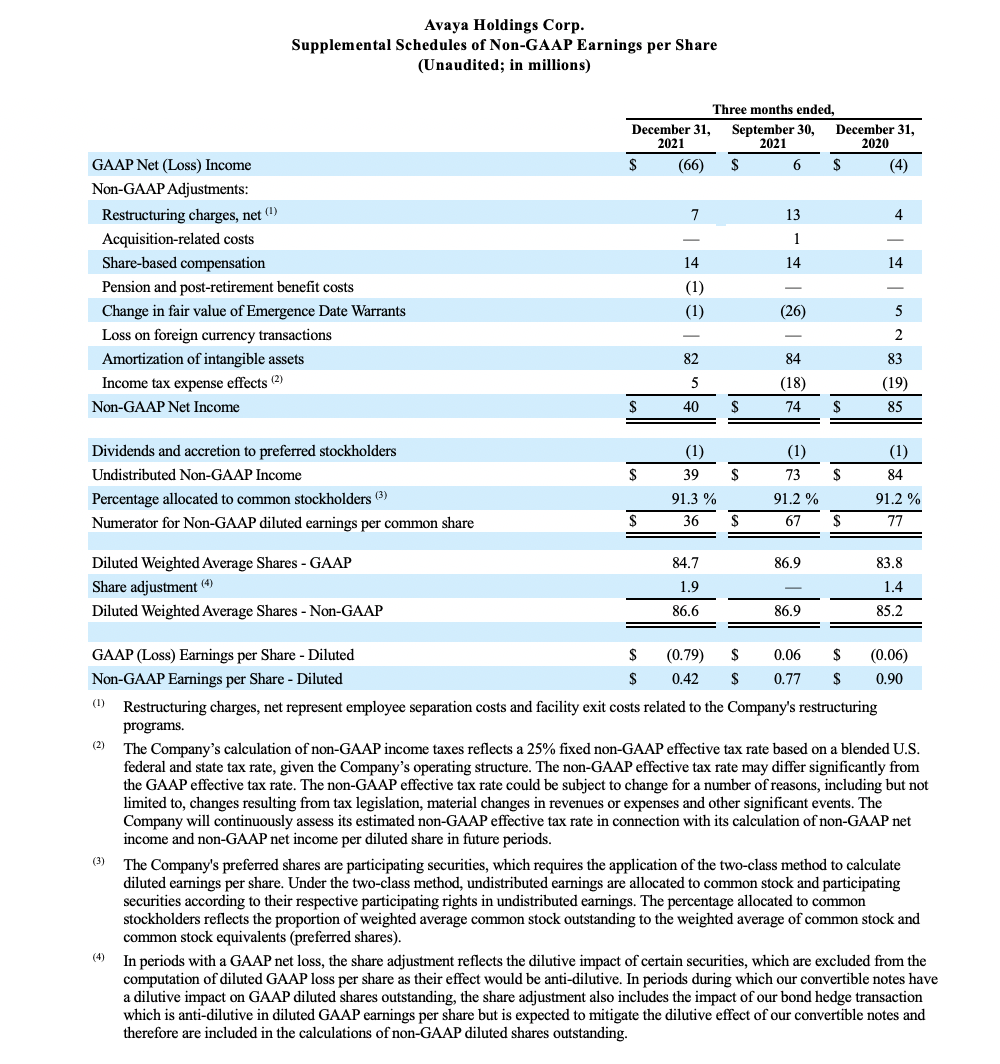

- GAAP Net loss was $66 million and Non-GAAP Net income was $40 million

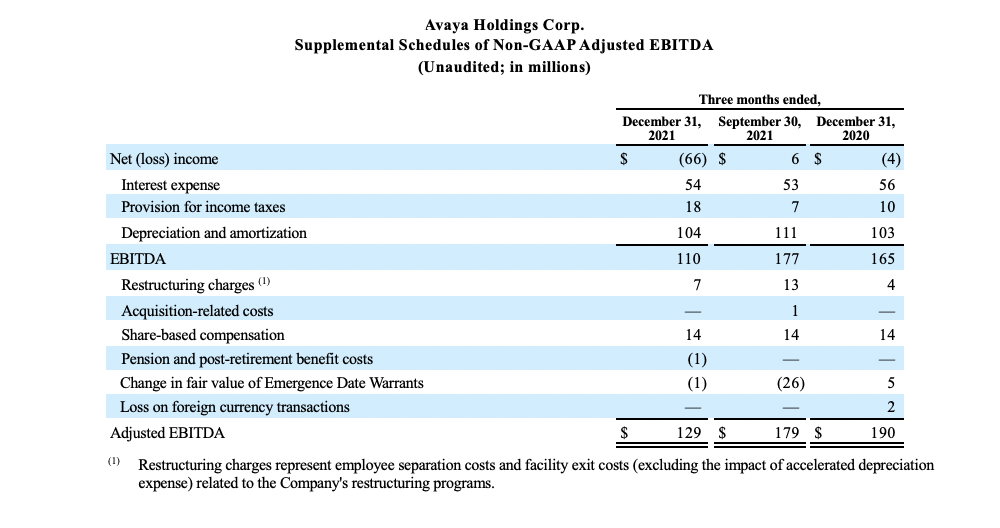

- Adjusted EBITDA was $129 million, 18% of revenue, down 750 basis points year over year

- GAAP Diluted Loss Per Share of $0.79 and Non-GAAP Diluted Earnings Per Share of $0.42

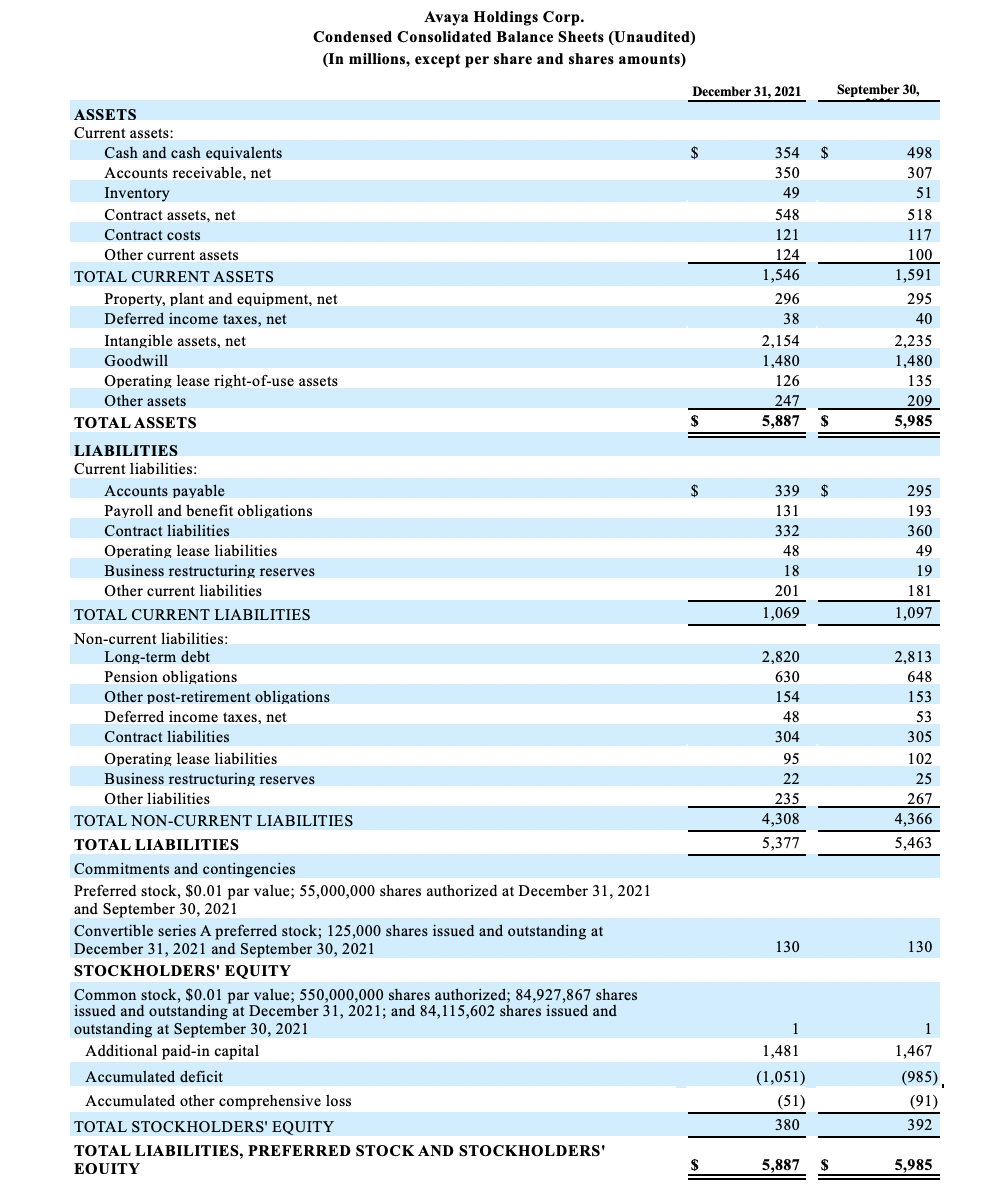

- Ending cash and cash equivalents were $354 million

“Our transition to the cloud continues to gain strength as our Avaya OneCloud ARR grew by 137% year over year primarily driven by our enterprise segment and contact center solutions,” said Jim Chirico, President and CEO of Avaya. “Market demand remains very strong, especially with large enterprises. This quarter, we yet again closed more than 100 deals with total contract value greater than $1 million. The breadth of our solutions, scale on which they operate, and global reach are unparalleled and as we closed out the quarter, we landed one of the largest deals in our history, a $400 million OneCloud Public CCaaS deal with a large global financial services company.”

Additional First Quarter Fiscal 2022 Highlights

- Remaining Performance Obligations ("RPO") of $2.3B

- Added over 1,400 new logos

- Significant large deal activity with 108 deals over $1 million TCV, 9 over $5 million TCV, 6 over $10 million TCV and 2 over $25 million TCV

- ~20% of OneCloud ARR came from customers generating $5 million or more in annual recurring revenue

- ~60% of OneCloud ARR came from customers generating $1 million or more in annual recurring revenue

- ~95% of OneCloud ARR came from customers generating $100K or more in annual recurring revenue

- ~60% of OneCloud ARR came from Contact Center customers

(1) During fiscal 2021, the Company identified an understatement of revenue by $3 million and $5 million in the Consolidated Statements of Operations for fiscal 2020 and 2019, respectively, and in an understatement of the opening Retained earnings adjustment recorded upon adoption of Accounting Standards Update No. 2014-09, "Revenue from Contracts with Customers" by $7 million. The Company concluded that the impacts were not material to fiscal 2021 or any prior period financial statements. As a result, the cumulative effect of the understatement was recorded during the fourth quarter of fiscal 2021, resulting in an increase to Revenue and Provision for income taxes and a decrease to Net loss of $15 million, $2 million, and $13 million, respectively, predominantly within the Products and Solutions operating segment.

(2) Non-GAAP gross margin, Non-GAAP operating margin (used below), Non-GAAP operating income, Non-GAAP net income, Non-GAAP earnings per share, adjusted EBITDA, adjusted EBITDA margin and constant currency are not measures calculated in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Refer to the "Use of non-GAAP (Adjusted) Financial Measures" below and the Supplemental Financial Information accompanying this press release for more information on the calculation of constant currency and a reconciliation of these non-GAAP measures to the most closely comparable measure calculated in accordance with GAAP.

Customer Highlights

- In Ontario, Canada, McMaster University has chosen Avaya OneCloud to extend our long-running partnership for a further five years. McMaster, with over 35,000 students and 10,000 staff, chose Avaya’s leading cloud solution to address the simultaneous challenges of increasing digital engagement across seven unique contact centers, reducing handling times and abandoned interactions, and improving analytics and workforce agility.

- Ascension, the largest non-profit hospital system in the US, signed a five year contract to standardize on Avaya across 110 hospitals with options to include clinics and professional offices in the future.

- Cupola Teleservices (Cupola), one of the Middle East’s largest BPOs and outsourced contact center service providers, has joined the growing list of Avaya Experience Builders around the world. Cupola chose Avaya OneCloud CCaaS and Avaya Spaces Learning as the basis for their new customer onboarding and agent training. In a competitive bid, we successfully beat Genesys to deliver a cloud solution that will streamline technology and processes, reduce costs, and significantly improve user and customer experience. This three year deal will enable Cupola to better serve their government and private sector customers across the region and beyond.

- In Brazil, we are very pleased that the ANA-National Water Agency has chosen Avaya OneCloud UCaaS as its only consolidated platform. In an expanded public competitive assessment, the customer chose to build its communications network using Avaya technology, replacing Ericsson's legacy systems in the process. This three-year agreement will enable the Agency to reduce costs, as it delivers significant improvements in user experience, processes, and transaction times.

- When it comes to Experiences that Matter, Kingsborough Community College, a City University of NY school, takes it so seriously that the management created a task force to improve student experiences. We worked with our partners to deploy an AI Chatbot solution built on Avaya OneCloud CPaaS that is available 24x7 to respond to inquiries and deliver valuable information. It also includes full reporting and analytics, which is changing the way they are serving and communicating with current and prospective students, parents and constituents.

- Our relationships with key customers continues to strengthen, exemplified by a new 700 license Avaya OneCloud Subscription deal signed with TELUS International in Canada. TELUS International will invest $1.3 million over three years to support its pace of growth as an industry leader in digital customer experience management. Avaya OneCloud technology and professional services will help power the differentiated experiences TELUS International designs, builds and delivers for their clients, and drive ongoing innovation through AI and automation.

- Medical West Hospital Authority, an affiliate of UAB Health System, is a long-time Avaya customer through our partner AT&T, and they selected Avaya Cloud Office by RingCentral for 1,400 staff members at their hospital and off campus locations. While discussing with Avaya new construction to open in 2024, it was decided not to wait but to move now to the cloud, which provided solid TCO and ROI. Key features such as faxing, video conferencing, integration with O365, mobility, “Park” and “Page” helped to tick every box Medical West had on their list.

Business Highlights

- Aragon Recognizes Avaya as a Market Leader in the Team Collaboration Globe, 2022. With leadership in four Aragon Globe reports – Team Collaboration, UC, Video Conferencing, and Intelligent Contact Center, Avaya is one of the only vendors in the industry that provides customers and end users a true, Total Experience with expertise across the entire landscape.

- Avaya was selected as a high performer in 2021 Frost & Sullivan Radar for Cloud Meetings & Team Collaboration Services Market.

- Third (of 18 vendors) in the Ventana Research Agent Management Value Index 2022 Vendor and Product Assessment.

- Major Player in IDC MarketScape Worldwide Customer Service Conversational AI 2021, and IDC MarketScape Conversational AI General Purpose 2021.

Financial Outlook - 2Q Fiscal 2022 - unless otherwise noted, values reflect January 31, 2022 FX rates.

- Revenue of $730 million to $745 million

- GAAP operating income of $29 million to $39 million; GAAP operating margin of 4% to 5%

- Non-GAAP operating income of $126 million to $136 million; non-GAAP operating margin of 17% to 18%

- Adjusted EBITDA of $155 million to $165 million; Adjusted EBITDA margin of 21% to 22%

- Non-GAAP EPS of $0.58 to $0.66

Financial Outlook - Fiscal Year 2022 - unless otherwise noted, values reflect January 31, 2022 FX rates.

- Revenue of $2.975 billion to $3.025 billion

- OneCloud ARR expected to be $900 million to $920 million by year end FY22

- CAPS revenue will represent between ~45% and 50% of Avaya's total revenue for FY22

- GAAP operating income of $179 million to $199 million; GAAP operating margin of 6% to 7%

- Non-GAAP operating income of $561 million to $581 million; non-GAAP operating margin of ~19%

- Adjusted EBITDA of $680 million to $700 million; Adjusted EBITDA margin of ~23%

- Non-GAAP EPS of $2.72 to $2.88

- Cash flow from operations expected to be approximately 1% of revenue, as an outcome of the company’s accelerated success in moving to a recurring revenue model which is resulting in higher working capital requirements

- Approximately 88 million to 90 million diluted weighted average shares outstanding

The company has not quantitatively reconciled its guidance for adjusted EBITDA, non-GAAP Operating income, or non-GAAP EPS to their respective most comparable GAAP measure because certain of the reconciling items that impact these metrics including, provision for income taxes, restructuring charges, net of sublease income, advisory fees, acquisition-related costs and change in fair value of warrants affecting the period, have not occurred, are out of the company’s control, or cannot be reasonably predicted. Accordingly, reconciliations to the nearest GAAP financial measures are not available without unreasonable effort. Please note that the unavailable reconciling items could significantly impact the company’s results as reported under GAAP.

As Avaya’s CAPS metric reflects revenue that is already recognized, management believes it is helpful to provide investors with a better view into the performance of the Company’s broader-based OneCloud software solutions that are driving the company’s recurring revenue growth by also providing a forward-looking metric, Annualized Recurring Revenue, or OneCloud ARR.

OneCloud ARR represents our estimate of the annualized revenue run-rate of certain components from active term OneCloud contracts (whether or not terminable) at the end of the reporting period. More specifically, OneCloud ARR includes OneCloud subscription revenue, ACO recurring revenue and revenue from CCaaS, Spaces, CPaaS, DaaS and private cloud, and excludes maintenance, managed services revenue and ACO one-time payments. The One Cloud ARR metric, combined with the company’s CAPS metric, provides investors enhanced visibility into Avaya’s transformational Cloud journey. Per period OneCloud ARR figures are provided in the slides published on Avaya’s website at http://www.avaya.com on the Investor Relations page.

Avaya’s outlook does not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments, or other significant transactions that may be completed after the date hereof. Actual results may differ materially from Avaya’s outlook as a result of, among other things, the factors described under “Forward-Looking Statements” below.

Conference Call and Webcast

Avaya will host a live webcast and conference call to discuss its financial results at 8:30 AM Eastern Time on February 9, 2022. To access the live conference call by phone, listeners should dial +1-877-858-7671 in the U.S. or Canada and +1-201-389-0939 for international callers. To join the live webcast, listeners should access the investor page of Avaya's website at https://investors.avaya.com.

Following the live webcast, a replay will be available on the investor page of Avaya's website for a period of one year. A replay of the conference call will be available for one week soon after the call by phone by dialing +1-877-660-6853 in the U.S. or Canada and +1-201-612-7415 for international callers, using the conference access code: 13726073.

About Avaya

Businesses are built by the experiences they provide, and everyday millions of those experiences are delivered by Avaya Holdings Corp. (NYSE: AVYA). Avaya is shaping what's next for the future of work, with innovation and partnerships that deliver game-changing business benefits. Our cloud communications solutions and multi-cloud application ecosystem power personalized, intelligent, and effortless customer and employee experiences to help achieve strategic ambitions and desired outcomes. Together, we are committed to help grow your business by delivering Experiences that Matter. Learn more at http://www.avaya.com.

Use of non-GAAP (Adjusted) Financial Measures

The information furnished in this release includes non-GAAP financial measures that differ from measures calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”), including financial measures labeled as “non-GAAP” or “adjusted.”

EBITDA is defined as net income (loss) before income taxes, interest expense, interest income and depreciation and amortization. Adjusted EBITDA is EBITDA further adjusted to exclude certain charges and other adjustments described in our SEC filings and the tables below.

We believe that including supplementary information concerning adjusted EBITDA is appropriate because it serves as a basis for determining management and employee compensation and it is used as a basis for calculating covenants in our credit agreements. In addition, we believe adjusted EBITDA provides more comparability between our historical results and results that reflect purchase accounting and our current capital structure. We also present adjusted EBITDA because we believe analysts and investors utilize these measures in analyzing our results. Adjusted EBITDA measures our financial performance based on operational factors that management can impact in the short-term, such as our pricing strategies, volume, costs and expenses of the organization, and it presents our financial performance in a way that can be more easily compared to prior quarters or fiscal years.

EBITDA and adjusted EBITDA have limitations as analytical tools. EBITDA measures do not represent net income (loss) or cash flow from operations as those terms are defined by GAAP and do not necessarily indicate whether cash flows will be sufficient to fund cash needs. Adjusted EBITDA excludes the impact of earnings or charges resulting from matters that we do not consider indicative of our ongoing operations but that still affect our net income. In particular, our formulation of adjusted EBITDA allows adjustment for certain amounts that are included in calculating net income (loss), however, these are expenses that may recur, may vary and are difficult to predict. In addition, these terms are not necessarily comparable to other similarly titled captions of other companies due to the potential inconsistencies in the method of calculation.

We also present the measures non-GAAP gross margin, non-GAAP operating income, non-GAAP operating margin, non-GAAP net income and non-GAAP earnings per share as a supplement to our unaudited condensed consolidated financial statements presented in accordance with GAAP. We believe these non-GAAP measures are the most meaningful for period to period comparisons because they exclude the impact of the earnings and charges noted in the applicable tables below that resulted from matters that we consider not to be indicative of our ongoing operations.

The Company presents constant currency information to provide a framework to assess how the company’s underlying businesses performance excluding the effect of foreign currency rate fluctuations. To present this information for current and comparative prior period results for entities reporting in currencies other than U.S. dollars, the amounts are converted into U.S. dollars at the exchange rate in effect on the last day of the company’s prior fiscal year (i.e. September 30, 2021), unless otherwise noted.

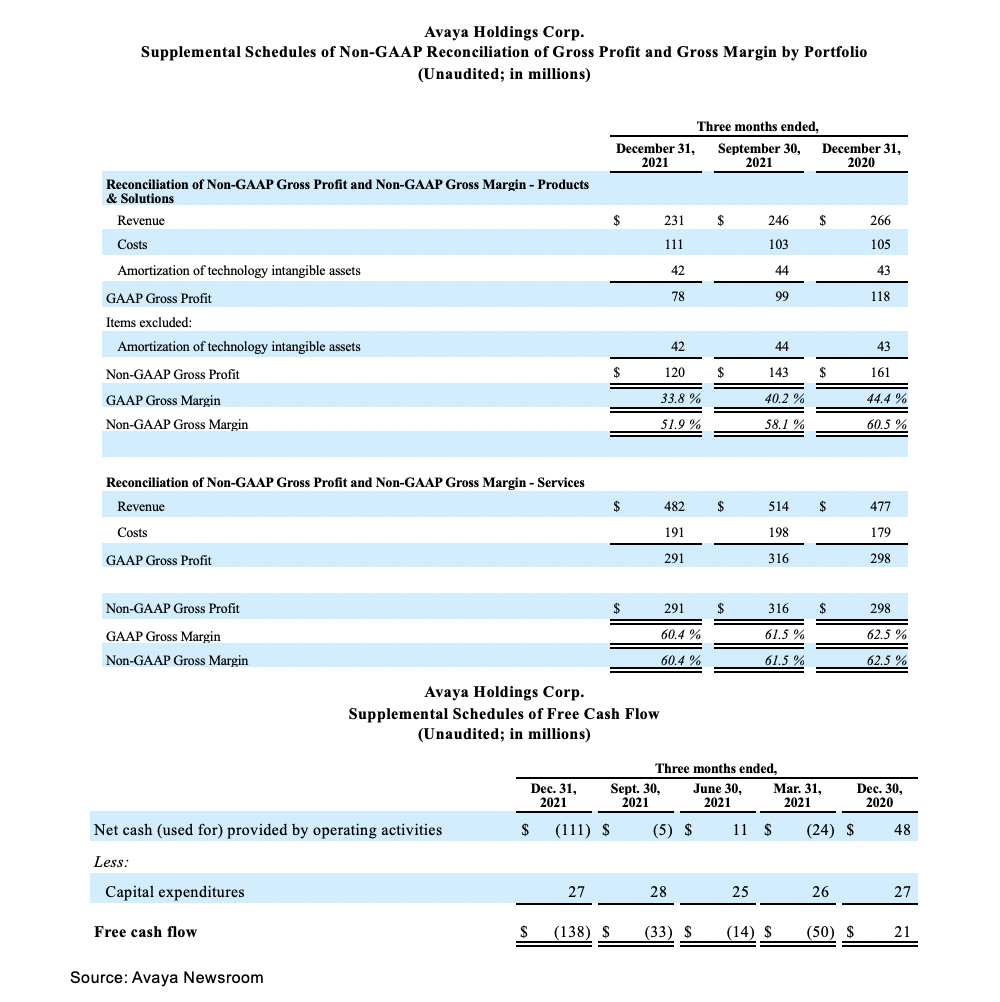

In addition, we present the liquidity measures of free cash flow. Free cash flow is calculated by subtracting capital expenditures from Net cash provided by operating activities. We believe free cash flow is a measure often used by analysts and investors to compare the cash flow and liquidity of companies in the same industry.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as substitute for, or superior to, the financial information prepared and presented in accordance with GAAP and may be different from the non-GAAP financial measures used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with the Company’s results of operations as determined in accordance with GAAP.

We do not provide a forward-looking reconciliation of expected first quarter and full year fiscal 2022 non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating income, non-GAAP operating margin, non-GAAP earnings per share or adjusted EBITDA guidance as the amount and significance of special items required to develop meaningful comparable GAAP financial measures cannot be estimated at this time without unreasonable efforts. These special items could be meaningful.

The following tables reconcile historical GAAP measures to non-GAAP measures.

Alex Alias and

Julianne Embry

Avaya PR

corpcommsteam@avaya.com

About Avaya

Businesses are built by the experiences they provide, and every day, millions of those experiences are delivered by Avaya. Organizations trust Avaya to provide innovative solutions for some of their most important ambitions and challenges, giving them the freedom to engage their customers and employees in ways that deliver the greatest business benefits. Avaya contact center and communications solutions power immersive, personalized, and unforgettable customer experiences that drive business momentum. With the freedom to choose their journey, there’s no limit to the experiences Avaya customers can create. Learn more at https://www.avaya.com.

Cautionary Note Regarding Forward-Looking Statements

This release contains certain “forward-looking statements.” All statements other than statements of historical fact are “forward-looking” statements for purposes of the U.S. federal and state securities laws. These statements may be identified by the use of forward-looking terminology such as "anticipate," "believe," "continue," "could,“ "estimate," "expect," "intend," "may," "might," “our vision,” "plan," "potential," "preliminary," "predict," "should,“ "will," or “would” or the negative thereof or other variations thereof or comparable terminology. The Company has based these forward-looking statements on its current expectations, assumptions, estimates and projections. These statements, including the Company’s outlook, do not include the potential impact of any business combinations, asset acquisitions, divestitures, strategic investments or other strategic transactions completed after the date hereof. While the Company believes these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond its control. Risks and uncertainties that may cause these forward-looking statements to be inaccurate include, among others, termination or modification of current contracts which could impair attainment of our OneCloud ARR metric; the duration, severity and impact of the coronavirus pandemic (“COVID-19”), including the emergence of new variants, governmental and business responses to COVID-19 and changes in infection rates, and the impact the pandemic and such responses have on our business, financial performance, liquidity; and other factors discussed in the Company's Annual Report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”). These risks and uncertainties may cause the Company’s actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. For a further list and description of such risks and uncertainties, please refer to the Company’s filings with the SEC that are available at www.sec.gov. The Company cautions you that the list of important factors included in the Company’s SEC filings may not contain all of the material factors that are important to you. In addition, in light of these risks and uncertainties, the matters referred to in the forward-looking statements contained in this report may not in fact occur. The Company undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

Source: Avaya Newsroom